Trends in Industrial Waste Management in 2021

From the coronavirus (COVID-19) situation, people have to change many behaviors to adapt which is becoming a new way of life (New Normal), be it social distancing, wearing masks, and reduced consumption due to economic conditions. As such, the industrial sector is affected by this change and needs to adjust in order to survive using technology to reduce costs, manage production chains, increase competitiveness, and remain focused on the efficient use of resources to not affect the environment, and to create a green economy, which is another important factor in competition.

For the Industry Outlook in 2021, the Thai economy will continue to slow due to the virus epidemic, but there is still a positive factor from vaccines which is expected to reach the population by the end of 2021. The government has taken remedial and recovery measures to stimulate the economy and in many projects. Thailand is expected to be supported by inbound capital, although fundamentals remain relatively weak and the recovery may take longer and inconsistent until foreign tourism returns significantly. This is likely to be after the global availability of the vaccine around the end of 2021, which will bring the economy and domestic consumption to a rebound and invest more in the industrial sector.

For the action plan in 2021, the Department of Industrial Works emphasizes 4 main plans, including the implementation of environmental protection policies and suppressing entrepreneurs who have committed environmental problems, the development of laws and digital systems to drive Thai industries towards Industry 4.0, promoting industrial sectors to develop competitiveness for sustainable business growth, and human resource development to have knowledge and skills in environmental auditing, social responsibility, safety, and on digital aspects which are consistent to the approach of the Company

Waste remains a major problem for the country, especially face masks and plastic bags, which has become a new problem after the 2020 campaign to phase out plastic bags. But, to protect public health and the new lifestyle in which people’s daily lives are shifting online and home delivery services usage have dramatically increased. This led to the increase in amount of this type of waste, but there is no proper management method, including measures by the government for managing waste generated from the special economic zones that is designed to promote investment. Such example is the EEC which still has only community waste guidelines. As for industrial waste management, the Company will continue to follow closely.

Corporate Governance Policies

Corporate Governance Policies

The company’s Board of Directors is aware of the principles of good corporate governance as key factors for the company’s business operations toward sustainable growth. Moreover, the company firmly believes in the importance of adding value and maximizing remunerations to shareholders and all stakeholders in the long-term. Hence, the Board of Directors has set and given approval to governance policies that promote transparency in the administration of the company’s business, project the rights of small shareholders and all stakeholders, while promoting shareholder engagement in overseeing the business operations of the company and setting risk management to ensure the stability of the company’s business. In addition, business philosophy and ethics have been setfor the company’s business operations to take place transparently, honestly and fairly with responsibility toward society. Furthermore, corporate governance policies are set in accordance with good governance principles that the Board of Directors make considerations for improvements and authorizing governance policies on a yearly basis. This is to upgrade the company’s governance with improved standards and in line with the good corporate governance of the Stock Exchange of Thailand, the Securities and Exchange Commission and the Thai Institute of Directors. The company has created good corporate governance and business ethics manuals for all persons involved in the company, whether the Board of Directors, the Board of Executives or employees, to have adherence as good guidelines for performing duties under their responsibility. Moreover, the company has included business ethics in the aforementioned manuals, as the company desires to promote for directors, executives and employees to operate and run the company’s business transparently and in accordance with the law with adherence to morals and ethics while recusing from activities that can lead to conflicts with the company’s business. Additionally, executives should provide good examples for their own subordinates.

The Company’s management adheres to practice guidelines under corporate governance principles and recognition of importance and responsibility to the Company’s shareholders and stakeholders, causing the Company to receive the following assessments from regulating agencies and organizations in 2019:

- Received a quality rating of the 2019 Annual General Meeting of Shareholders at the level of 99.00 percent from the quality of the AGM Assessment Program of the Thai Investor Association

- “Excellent” for the Corporate Governance Report 2019 (CGR 2019) of Thai Listed Companies from Thai Institute of Directors (IOD)

- SET Sustainability Awards in the category of Thailand Sustainability Investment 2019 from the Stock Exchange of Thailand

- The Environmental, Social and Governnance 100 Certificate of 2019 as one of 100 companies with outstanding environmental, social and governance performance among 683 listed companies.

In 2017, the Securities and Exchange Commission issued Corporate Governance Code (CG Code 2017) as principles for the Board of Directors to adapt to governance in order to ensure good business performance in the long-term, reliability for shareholders and benefit in building sustainable value for the business. The eight main principles for the Board of Directors are as follows:

- Awareness of the Board of Directors’ role and responsibility as a corporate leader building sustainable value for the business.

- Setting of main business objectives and goals for sustainability.

- Promotion of an efficient Board of Directors.

- Recruitment and development of high-ranking executives and personnel management.

- Promotion of innovation and responsible business operation

- Assurance of appropriate risk management and internal control systems.

- Maintenance of financial reliability and disclosure of information.

- Support of shareholder participation and communication.

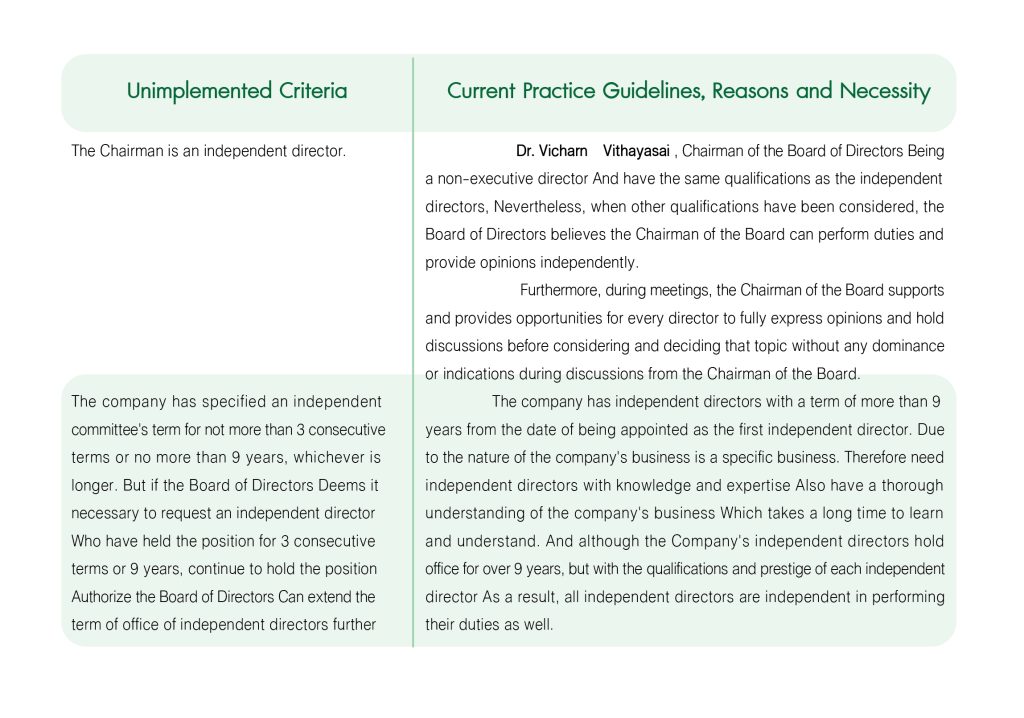

The Board of Director reached a resolution to consider implementing the Corporate Governance Code 2017 by considering and having awareness of roles and duties as the Governing Board. All directors have thoroughly considered implementing the aforementioned principles and have understood the benefits and importance of applying the CG Code to build value for the business with sustainability. Nevertheless, regarding unsuitable principles for the Company’s business operations, the Board of Directors considered and issued appropriate replacement measures along with recording measures as part of the Board of Directors’ resolution in order to hold annual reviews. The Company discloses the Company’s corporate governance policies on the website for communication outside the organization and dissemination to the organization’s employees to acknowledge the Company’s corporate governance along with promoting employee participation in complying with the aforementioned policy.

Furthermore, the Company adheres to and places importance on Corporate Governance Code 2017, which covers principles of the Organization for Economic Co-operation and Development in all five categories for use as guidelines in developing policies with coverage of rights and equitable treatment of shareholders and stakeholders, structures, roles, duties, responsibilities and independence of the Board of Directors, disclosure of information and transparency, risk control and management including business ethics. This is to help the Company’s business management and operation to be effective and transparent. The Corporate Governance Code covers the following five principles:

Section 1 : The Rights of Shareholders

The Company places importance on shareholders as investors in the Company’s assets and the Company’s owners. The Company has the Board of Directors appointed by shareholders to perform duties on behalf of shareholders. Furthermore, shareholders have the right to make decisions regarding the Company’s significant changes. Therefore, the Company has a policy to support, promote and facilitate convenience to allow shareholders to exercise rights, particularly the following basic shareholder rights:

- The right to purchase, sell or transfer the Company’s shares as prescribed by the law.

- The right to receive accurate, complete, sufficient and timely information in appropriate formats for decision-making to monitor operations. In addition, the Company has no policy to obstruct or create barriers in communications between any shareholders.

- The right to attend shareholder meetings, express opinions, provide recommendations, make inquiries at shareholder meetings and make decisions on the Company’s main issues.

- The right to appoint and dismiss directors.

- The right to appoint certified public accountants and specify remuneration for certified public accountants.

- The right to receive the Company’s profit shares in the form of equal dividends.

- The right to receive share certificates, transfer shares and redeem shares equitably in the Company’s name.

- The right specify or revise the Company’s objectives, regulations and memorandum of association.

- Other rights decreed in any other related laws and regulations including the Company’s regulations.

In addition to supporting shareholders to exercise basic rights, the Company treats shareholders equitably such as by providing up-to-date important information via a website, arranging for shareholders to visit the business and the Company does not perform any actions to violate or suppress shareholders’ rights.

Shareholder Meetings

In 2019, the Company held the annual general meeting of shareholder on 30 April 2019. The Company has performed the following actions regarding corporate governance for shareholders’ rights:

In the year 2019, the company held 2 shareholders' meetings.

- Annual General Meeting of Shareholders for the year 2019, held on 30th, April 2019

- The Extraordinary General Meeting of Shareholders No. 1/2019 held on December 30th, 2019, in order to ask the shareholders to consider and approve the plan to bring ETC's shares to be listed on the Stock Exchange of Thailand / MAI

In the past, the company Proceeded with good corporate governance For the rights of shareholders as follows

1. Treatment of Shareholders before the Annual General Meeting of Shareholders

1.1 The Company promotes and facilitates every shareholder group including institute shareholder to fully exercise the right to attend shareholder meetings and vote.

1.2 The Company provides opportunities for minority shareholders to present topics for inclusion as meeting agendas and to nominate individuals to be elected as the Company’s directors at the general meeting of shareholders in advance. The Company notified shareholders via the news system of the Stock Exchange of Thailand in addition to announcing clear criteria, specifications and steps for presenting the aforementioned meeting agendas on the Company’s website at bwg.idea-boomer.com on 15 November 2017. Shareholders were able to present topics to the Company from 15 November 2017 to 15 January 2018.

1.3 The Company sends meeting invitations to all shareholders with meeting information, date, time, place and agendas including objectives, reasons and opinions of the Board of Directors accompanying each agenda along with all information related to topics being decided at the meeting in Thai and in English no less than 21 days before the meeting for shareholders to consider. The Company sent meeting invitations to shareholders by mail on 6 April 2018. At the annual general meeting of shareholders in 2018, the Company presented the following agenda items for shareholders to consider approval:

- Approval of financial statements and the consolidated profit-loss statement

- Approval of profit allocation to pay dividends and legal reserve.

- Approval of bonus payments to the Board of Directors.

- Approval of directors’ remuneration.

- Approval of director appointments.

- Approval to appoint the certified public accountant and remuneration specification.

- Approval to reduce and increase the Company’s registered capital.

- Approval to issue and offer common shares to increase the Company’s capital in a general mandate.

- Approval of revisions or additions to the Company’s memorandum of association.

1.4 The Company disseminated meeting invitations to the annual general meeting of shareholders in 2019 on the Company’s website at bwg.idea-boomer.com in Thai and English since 21st, March 2019 to allow shareholders

1.5 The Company provides opportunities and specifies clear criteria for shareholders to send questions in advance of the annual general meeting of sahreholders of 2019. Shareholders were able to send questions in advance to the Company Secretary, Better World Green Public Co., Ltd., 488, Soi Ladprao 130 (Mahadthai 2), Khlong Chan, Bang Kapi, Bangkok, 10240, or Email: siriphorn.s@bwg.co.th.

1.6 The Company attached Power of Attorney Forms A, B and C with shareholder meeting invitations to allow shareholders with inconvenience preventing shareholders from attending the meeting personally to grant power of attorney to any other persons or independent directors appointed by the Company as power of attorney grantees to attend meetings and vote on behalf of shareholders by following conditions specified on power of attorney letters.

1.7 The Company fully facilitates shareholders’ right to attend meetings and vote. The Company used the Pavilion Room, 8th Floor, The Grand Four Wings Convention Hotel, 333 Srinagarindra Rd., Hua Mak, Bang Kapi, Bangkok, 10240 as the meeting venue with sufficient width to support shareholders and convenience for traveling. In addition, the Company prepares sufficient snacks and beverages to support meeting attendants.

2. Treatment of Shareholders on the Annual General Meeting of Shareholders’ Date

2.1 The Company provides sufficient personnel and technology for shareholder meetings including document examination, meeting attendance registration, vote counting and voting results on each agenda to allow meetings to be fast and accurate. The Company allows shareholders to register at least one hour before the meeting and allows shareholders who wish to attend meetings after the registration time to vote on agenda items being considered as a meeting quorum from the agenda when shareholders attended the meeting. In 2019, the Company used the meeting program of Thailand

2.2 The Company allows shareholders to vote with one share being equal to one vote and, to facilitate voting and vote counting, the Company prepares voting forms for each agenda items, especially for director appointment agenda items. The Company allows shareholders to vote and appoint directors individually. Furthermore, the Company allows shareholders to volunteer as witnesses in counting votes and the Company provides legal consultants to count votes for transparency in voting and vote counting along with disclosing voting results to the meeting and recording in the minutes of the meeting.

2.3 At the beginning of the meeting, the Chairman of the Board, the Chairman of every sub-committee, every director, high-ranking executives, the certified public accountant and legal consultants attend the meeting together. Before convening the meeting, the Chairman of the Board who acts as the Chairman of the meeting assigned the staff to explain all criteria related to the meeting such as votes, etc.

2.4 Meetings are held according to agenda items notified in meeting invitations sent to shareholders in advance without changing the aforementioned agenda and without asking the meeting to consider other issues than those specified in the meeting agenda because the Company does not have a policy to add agenda items to meetings without notifying shareholders in advance.

With regard to directors who hold a stake in meeting agendas, the Company specifies stakes held by directors in meeting agendas and the Chairman of the meeting notifies the meeting of any directors with stakes or relation in any agenda before considering the aforementioned director. Stakeholding directors will not attend the meeting on that agenda.

2.5 The Chairman of the meeting gives shareholders equal rights to express opinions and make questions at the meeting before voting and summarizing meeting resolutions on each agenda by recording issues, inquiries and significant opinions in the minutes to the meeting in order to allow shareholders to subsequently examine the minutes to the meeting.

3. Treatment of Shareholders after the General Meeting of Shareholders

3.1 The Company discloses resolutions of the meeting of shareholders along with voting results in the evening of the meeting day through the SET’s electronic system and on the Company’s website.

3.2 The Company makes accurate and complete records of minutes to meetings in Thai and English for shareholders to examine. The Company records the names and positions of directors in attendance, voting methods, shareholders’ opinions, directors’ explanations and meeting resolutions clearly along with categorizing votes in agreement, disagreement or abstention and delivering voting results to the SET via www.setportal.set.or.th within 14 days from the shareholder meeting date along with disseminating the aforementioned reports on the Company’s website.

3.3 The Company records images of the meeting’s atmosphere to allow shareholders not in attendance at the meeting to acknowledge on the Company’s website.

3.4 After the shareholder meeting decides to pay dividends, the Company reports meeting resolutions and dividend payout information to shareholders via the Stock Exchange of Thailand’s dissemination system and coordinates with Thailand Securities Depository Co., Ltd. to ensure that shareholders receive accurate and full dividend payments. The Company specifies the dividend registry closing date no less than five business days after approval from the meeting of shareholders in line with principles recommended by the Stock Exchange of Thailand.

3.5 The Company considers recommendations and opinions from shareholders and auditors in assessing meeting results and searches for guidelines to make revisions/modifications in order to continually improve shareholder meetings.

From the assessment of the quality of the Company’s 2019 Annual General Meeting of Shareholders conducted by the Thai Investors Association, the Company received a score of 99.00 precent.

Section 2 : The Equitable Treatment of Shareholders

The Company respects shareholders’ and institute investors’ legal rights and/or in compliance with the Company’s regulations. The Company treats shareholder equitably, regardless of whether shareholders are minor shareholders, foreigners, institute investors or major shareholders without consideration of gender, age, disability, ethnicity, citizenship, religion, beliefs or political opinions. All of the Company’s shareholders are entitled to equitable treatments and protection of basic rights as follows:

1. Equitable Treatment

1.1 In shareholders’ meetings, the company has policy for preserving the rights of every shareholder by not increasing meeting agendas without notifying other shareholders in advance of the meeting to allow shareholders the opportunity to study meeting agenda information prior to reaching a decision. Every shareholder as the right to vote based on the number of shares held. Each share has one vote and there are no shares with special privileges limiting the rights of other shareholders.

1.2 The Board of Directors allows minor shareholders to propose agendas at the annual shareholders’ meeting and nominate persons with proper qualifications to become directors by announcing for the acknowledgement via SEC channels and on the company’s website with clearly defined criteria. The company has allowed shareholders to propose agendas and director names in advance since 15th , November to 15th January 2019. Any company shareholder or shareholders with total shares amounting to no less than 1 percent of shares with rights to vote may propose agendas and nominate director names. No shareholders proposed any agendas or nominated any persons as directors.

1.3 For transparency and accountability, the company has arranged for the use of voting Ballots on every agenda and allows shareholders to nominate directors individually

1.4 The Board of Directors allows shareholders who are unable to attend meetings to grant proxy rights to other persons, independent directors or the Managing Director to attend meetings on behalf of the shareholders by sending letters granting proxy in the forms prescribed by the Ministry of Commerce to attend meetings and vote on behalf of shareholders unconditionally. In cases where shareholders have granted proxy rights to (Form B) other persons, the company will give rights and treat the person granted proxy rights as a shareholder. Furthermore, the company discloses letters granting proxy rights with details and procedures on the company’s website for 30 days before the meeting.

1.5.The Company provides opportunities for shareholders who do not have the convenience to attend meeting in person to grant proxy rights to other persons or any independent director nominated by the Company. The Company grants rights to and treats proxies as shareholders. In addition, the Company provides convenience for shareholders who are unable to attend meetings in person by sending proxy letter forms meeting detailed and clear specifications of the Department of Business Development, Ministry of Commerce, with shareholder meeting invitations in Thai and English no less than 21 days in advance of the meetings date. And to create accuracy and prevent problems from proxies’ meeting attendance, the Company displays information concerning the meeting, meeting schedules and agendas including steps, documents and evidence required to grant proxy rights on meeting invitations and the Company’s website (http://bwg.idea-boomer.com) in the part of investor relations under the topic of Investor Relations more than 30 days in advance of the meeting. Shareholders can inquire for more information by telephone and email from Investor Relations (see the topic of Investor Relations for more information).

1.6. Since the majority of shareholders attending the general shareholders 'meeting are Thai, therefore, the shareholders' meeting is conducted in Thai. However, for the benefit of communication and convenience for foreign shareholders, the company has prepared documents in two languages, namely Thai and English, such as an invitation letter to the shareholders' meeting. proxy Minutes of the shareholders' meeting Annual report etc. and create a website for the company (http://bwg.idea-boomer.com) in 2 languages ??to provide services to interested shareholders.

1.7. The company delivered the meeting invitation letter. Along with supporting documents for consideration of various agendas. To shareholders no less than 21 days before the meeting date and bring details about the meeting Meeting schedule Agenda Published on the company's website (http://bwg.idea-boomer.com) more than 30 days before the meeting date.

1.8. The company does not specify conditions or rules that require document certifications by government agencies or other rules that cause complications for shareholders in proxies. As well as the company Facilitated the duty stamp issuance service in the proxy form for the proxies attending the meeting And provide staff to provide photocopy services that need to be attached And check the accuracy of the document Without charge at the registration point to reduce the burden of procurement of stamp duty and copying documents of shareholders Registration is open for 1 hour before the meeting. The company uses the meeting program of the company. Thailand Securities Depository Company Limited (TSD) for registration and vote counting Including providing a reception for shareholders to attend the meeting.

2. Protection of against Abuse of Insider Information and Conflicts of Interest

The company has specified guidelines to store and prevent the abuse of insider information in ethics for directors and employees to prevent abuse of insider information for personal gain and unlawful gains of others, which is considered as taking advantage of other shareholders or causing overall damage to shareholders with the following essential principles:

2.1 The company keeps insider information and has set procedures to prevent the use of insider information for self gain or gains for relations i.e. inside trading. The procedures concerning the leaking of insider information or secrets of company have been provided in the company's policy and regulations manual as well as in the procedures concerning trading of securities. The use of inside information and conflicts of interest has also been provided in business ethics and has been communicated to directors, executives and employees.

The company prohibits directors, executives, employees and relevant persons to buy or sell securities of the company prior to the release of the financial statement and insider information to public and should wait until at least 24 hours after the release of information to public before buying or selling securities of the company. The company has established disciplinary actions for violations of use of inside information for self gain. These could include written warning, wage cut, suspension without pay and termination. Disciplinary actions is taken depending upon willfulness and severity of the violation.

2.2 Directors and executives have a duty to report their securities holding of the company and disciplinary actions in accordance with the Securities and Exchange Act B.E. 2535 (1992). If directors or executives buy or sell securities of company, they are required to report their securities holding of the company, including their spouses and minor children in accordance with Section 59 of the Securities and Exchange Act B.E. 2535 (1992) to the Securities and Exchange Commission within 3 working days and this information must be disclosed to public.

2.3 The board of directors have established guidelines to prevent directors and executives who have any personal interest in any transactions or on matters directly affecting the company to participate in the decision-making or approval process of the company. Prior to the board of directors meeting, directors who have any interest in any transactions are requested to disclose their interest in any transactions and that director has no right to vote on such issues.

2.4 The company has a simple shareholder structure and share price volatility is normal.

2.5 Established guidelines regarding not using insider information for unlawful gains in the Handbook on Business Ethics and Code of Conduct

2.6. The Company adopted measures and steps for granting approvals of related party transactions as prescribed by law and in accordance with standards prescribed in the requirements of the Capital Market Supervisory Board and SET by implementing the “Rules of Entering into Related Party Transactions”, which were approved by the Board of Directors. For related party transactions which required approval from shareholder meeting prior thereto, the Company would disclose information on such transactions in the letter of invitation to the meeting, e.g. names and relationships of related parties, nature of the transactions, the transaction pricing and valuation policy, reasons for making such transactions including opinions of the Board of Directors and theindependent financial advisor on such transactions, etc., and deliver the letter of invitation to the meeting within such time as fixed, and properly and completely fulfilled all relevant obligations in accordance with requirements of the Capital Market Supervisory Board and SET. In 2019 the Company had no related party transaction which required prior approval from the shareholder meeting,The Company disclosed the details of related transactions of all types made during. And 2019 in the annual report and Report 56-1 under the heading “Connected Transactions”

2.7. The Company does not have a business group structure that engages in related transactions that may have conflicts of interes

2.8. The Company strictly complied with laws and requirements of the Capital Market Supervisory Board and SET relating to transactions on acquisition or disposal of assets. In case of transactions on acquisition or disposal of assets approved by shareholder meeting, the Company would disclose details thereof in the annual report and the 56-1 Form of that year. Until now, the Company had no transaction on acquisition and disposal of assets which required compliance with notification of the Capital Market Supervisory Board and the Stock Exchange of Thailand.

3. Stakeholder Information Disclosure

company has specified the following guidelines on disclosure of stakeholder information of directors and executives for transparency to prevent problems due to conflicts of interest:

3.1. Directors are required to notify the company without delay when a director and family members have interests or are shareholders in any business with potential interests or conflict with the company having a direct or indirect stake in any contracts made by the company or when a director and family members hold securities in the company and affiliated companies. Stakeholder Directors and executives must be excluded from participation in discussions aimed at rendering opinions or voting to approve the aforementioned transactions.

3.2. Directors and executives are required to report securities held by the company at every meeting of the Board of Directors. The aforementioned agenda is to notify directors that directors and executives, including spouses and children who have not reached adult maturity and related persons according to Article 258 of the Securities and Exchange Act of B.E. 2535 (1992 A.D.), are under obligation to prepare and disseminate reports on security holdings, including reports on changes in security holdings for the SEC whenever securities are purchased, sold, transferred or received within three days ( www.sec.or.th ) from the securities purchase/sale date.

In 2019, the company treated shareholders equally and there eas no complaints of shareholder rights violation or the use of inside information for personal gain.

Section 3: The Role of Stakeholders

The Company and its Board take into account the rights of all stakeholder groups and consistently abide by corporate governance principles, best practices, and other supporting guidelines, including our Code of Conduct, to ensure equal and proper treatment of all stakeholders. This takes into account, although not exclusively, employees, shareholders, customers, business partners, competitors, creditors, communities in which we operate, society as a whole, and the environment. Furthermore, the Company abides by international human rights principles and anticorruption guidelines to promote the development of society as follows:

1. Shareholders : The Company performs duties to shareholders with honesty and fairness and manages business for stable progress and interest of shareholders by disclosing information to shareholders equally, regularly and completely. The company provides opportunities to propose opinions, suggestions, including either additional agenda items or candidates to serve as directors.

2. Customers : The Company has a quality policy as well as the ISO 9001:2008 quality system dedicated to creating customer satisfaction and allowing customers to trust that they are receiving high quality products and services at reasonable prices. The Company aims to maintain good customer relations and is dedicated to ensuring that any customer complaints are dealt with fairly and efficiently. The Company will also safeguard any customer data that should not be divulged, unless such customer information must be disclosed to third parties under the Sustainable Development Policy and Code of Conduct on responsibility to customers.

3. Business partners and creditors : The Company has a policy to treat every business partners and/or creditors with equality and fairness, adhering to the business operation to create credit worthiness in the eyes of creators on the realization of mutual benefits whilst avoiding a situation which can give rise to conflict of interest or damage to the Company’s reputation or illegal as follows:

- The Company shall do its best to endeavor to comply with any contract, agreement, or various conditions concluded with business partners and/or creditors. If compliance with the conditions cannot be achieved, the Company shall promptly inform business partners and/or creditors within a reasonable time in order to determine sound and reasonable remedial actions.

- The Company shall provide business partners and/or creditors with adequate data, and shall not provide any false, distorted, or incomplete data which, in turn, can cause business partners and/or creditors to have a misunderstanding and impact decisions.

- The Company shall conduct financial management in a way that business partners and/or creditors shall have confidence in its financial status and ability to pay Company debt

- The Company shall by no means, ask for, receive, or grant any trade benefits to business partners and/or creditors with dishonesty. If dishonest behavior occurs, the Company shall notify business partners and/or creditors of all details and cooperate with them to correct the problem with speed as well as take measures to prevent recurrence.

- Deals with business partners and/or creditors shall be conducted in a good manner without damage to the Company’s reputation or any illegal activity. Conduct should be on a basis of equality, fairness, and mutual benefits.

4. Communities / Society / Environment : The company has a responsibility to communities and society to follow standards related to safety, security, occupational health and environment and address concerns that impacts natural resources and the environment.

5. Employees : Our employees are our most valuable asset. Therefore, there are policies in place to foster advancement of employees, driven by procedures for human resource improvement including the provision of both professional and general improvement training courses on a regular basis. Also, the Company values equal and fair treatment of its employees.

- Remuneration Management : The Company has a policy to determine appropriate Remuneration and other benefits for employees in line with the Company’s performance both in the short and long terms. The Company has implemented a job evaluation system to determine the value or worth of a particular job in relation to other jobs within the organization in order to provide merit compensation. Regular salary and benefit surveys are conducted to benchmark the Company against the market, while the cost-of living index is taken into account to ensure that compensation packages and rewards are reasonable and competitive.

- Welfare and Benefits : The Company provides appropriate employee benefits such as health check, life and accident group insurance, aid for injured from working, provident fund, marriage financial aid, funeral financial aid, disaster, and gift for patient.

- Employee Well-being : The Company places consistent priority on employee well-Being. In addition to providing a safe and healthy working environment as required under occupational health, safety, and environment legislation, the company also aims to improve overall quality of life for its employees by adhering to international standards for workplace health and safety, providing ergonomic office equipment, and offering facilities and programs to encourage wellness among all employees. The Company has also set up a provident fund, run by a professional fund management company certified by the Securities and Exchange Commission, to help employees prepare for financial security in retirement.

- Employee Development : The Company supports and invests in continuous employee development throughout the organization with a systematic approach whereby managers must consistently plan, review, and report on staff development activities that are aligned with their business direction. This development covers managerial knowledge and skills, leadership, professional/functional knowledge & skills, critical thinking skills, and global perspectives. The Company provides a career path for continual advancement, supported by a succession plan and a talent development program, in order to achieve objectives, maintain a culture of good corporate governance, and fulfill commitments to all stakeholders.

6. Business Competition : It is the Company policy to support and promote free and fair competition in business in pursuant to the rules of fair competition. It is against the aforementioned policy to resort to any form of business competition in which information from competitors is acquired in an unlawful or unethical manner or which intentionally aims to destroy the reputation of competitors with groundless slander as described in the Code of Conduct.

7. The Media : Any information about the Company to be supplied to outside sources must be factual and accurate, and presented with care. This policy has been included in the Code of Conduct. Those who do not have relevant duties or receive assignment cannot give information or interviews to press or public in reference to the Group in any way. This prohibited action can give rise to undesirable impact on the reputation and business operations of the Company.

8. Safety, Occupational Health, and Environmental Conservation : The Company considers the management of safety, health and environment conditions in workplace to be of utmost importance to successful and sustainable business operations. This includes ensuring safety of the work environment for company employees as well as customers and other relevant persons. The Company therefore maintain has Policy on Occupational Safety, Health, and Environment as follows:

- All employees throughout all levels of the Company are responsible for maintaining the safety, health, and environment conditions in the workplace by cooperating to ensure the safety of life and property.

- The administration of occupational safety, health, and environment procedures is carried out in accordance with all applicable laws, regulations, and other relevant provisions throughout the Company’s business operations.

- The Company maintains procedures as well as a working plan concerning occupational safety, health, and environment, including review of the plan and continual follow up and assessment of results. The Company also establishes preventative measures to control risk which may give rise to loss from accident, injury, or illness due to improperly following procedures or any errors which may occur.

- The Company promotes and supports performance of duties by personnel in a manner which does not create danger to life, body, mind, or health.

- The Company communicates and distributes information regarding occupational Safety, health, and environment to company personnel as well as to stakeholders involved in the Company’s operations, in an appropriate manner.

9. Environmental Preservation and the Efficient Use of Resources : The Company encourages the efficient use of resources for maximum benefits concerning environmental impacts and has stipulated systematic measurement to prevent impacts.

10. Respecting Human Rights : The Board of Directors, executives and employees at every level adhere to principles of human rights, supports treating every person with respect and fairness, respect and consider human dignity, equality and respect for personal rights, freedoms and equality without discrimination for reasons of nationality, citizenship, origins, religion, gender, language, beliefs, education, race, disability, expression of political opinions, economic status, membership in groups or any other social status unrelated to work or any other topics.

11. Avoiding Infringement of Intellectual Property : The Company has a policy and guidelines to respect by not violating intellectual property or copyrights for which directors, executives and employees have to follow the ethics on intellectual property and copyright.

12. Anti-Corruption : The Board of Directors has established and improved the policy on anti-corruption of the Company clearly and also determined the manual on anti-corruption measure to be the guidelines for directors, executives and employees. It focuses on preventing and fighting against all kinds of corruption directly and indirectly, including not involving with bribes and corruption with officers and entities in the public and private sector in order to acquire or maintain competition advantages. In addition, the Company appoints the Anti-Corruption Working Group to coordinate with executives and all sections in the organization in order to improve related rules, requirements and practices correspondingly and appropriately based on the current situations. Moreover, the policy and manual on anti-corruption measure are published to external persons. In 2016, the Company was verified to be a member of Private Sector Collective Action Coalition against Corruption Council on April 22, 2016 from the Private Sector Collective Action Coalition against Corruption. The Company has disclosed an Anti-Corruption Policy on bwg.idea-boomer.com

13. Procedures for Whistle-Blower and Mechanisms for Whistle-Blower Protection : The Company has set up a Whistle-blowing Policy to provide channels for reporting and to encourage all employees to report any information on misconduct and/or fraud occurring in the Company. This is will prevent misconduct and/or fraud which may occur in the organization and help detect and reduce damage from misconduct and fraud. In addition, this Policy provides protection to employees who provide information, cooperation or assistance to the Company concerning misconduct and fraud from any kind of threat or unfair act.

Complainants

Employees, relevant officers, or a third party coming across or becoming aware of dubious acts including those affected by the company’s business or the conduct of company directors, executives, or employees that violate laws, regulations, the company’s corporate governance, code of conduct, policies, and regulations and suspected corrupt practices. The company encourages complainants to identify themselves and provide adequate evidence.

Channels for Reporting Complaints and Clues of Wrongdoing and Corruption

The Company assigns the Chairmand of the Audit Committee to consider accepting reports, clues and complaints concerning actions which may create suspicion of bribery and corruption in the Company directly or indirectly. Complainers must specify information on the topic of the clue, complaint, evidence or sufficient information for examination including names, addresses and telephone numbers through the following channels:

1. Submit via The audit committee’s e-mail

E-mail:audit@bwg.co.th

2. Submit via The Company’s online channels

bwg.idea-boomer.com

Facebook : BWG – Better World Green

Line ID : @bwgcenter

3. Report by telephone

02-012-7888 ext. 211 (Human Resources Department).

4. Report by addressed mail or submit letters directly to the following:

- Chairman of the Audit Committee.

- Chairman of the Investigative Committee.

- Chief Executive Officer and Managing Director.

- Company Secretary.

- Manager, Internal Audit Department.At Better World Green Public Co., Ltd., 488, Soi Ladprao 130 (Mahadthai 2), Khlong Chan,Bang Kapi, Bangkok, 10240.

In cases where informants or complainants have complaints related to the Board of Directors, any sub-committee and high-ranking executives, please send complaints directly to the Chairman of the Audit Committee.

Company Actions Taken after Receiving Complaints

1. When the Company receives clue reports, the complaint recipient will examine, gather facts or assign trusted persons, agencies or the Investigative Committee to examine the facts.

2. If the facts have been investigated and information or evidence show reason to believe the accused to have committed bribery and corruption, the Company will allow the accused to acknowledge the accusations and prove innocence by presenting additional information or evidence showing no involvement in actions according to accusations.

3.If the accused did commit bribery and corruption, the accused will be considered for disciplinary action according to the Company’s regulations. If the aforementioned actions are illegal, the accused will also be punished according to the law. In the area of disciplinary actions according to the Company’s regulations, the Chief Executive Director’s judgment is considered final and must be reported to the Audit Committee for further acknowledgement.

4. Informants who report clues or complaints must report honestly. If the Company discovers clues or complaint reports to be dishonest or intended to cause damage and disputation to others, etc., and the aforementioned person is an employee of the Company, that person will be disciplined in line with regulations. However, in cases where the person is an outside person and the Company is damaged, the Company will consider prosecuting that person.

In cases where complaints are important such as issues with impact on the Company’s reputation, image or financial status, conflicts with the Company’s policy in business operations or topics related to the Company’s high-ranking executives and directors, etc., the Audit Committee has the duty to accept topics, search information and examine facts as notified in order to report to the Board of Directors for consideration and punishment as the Board of Directors considers appropriate.

Disciplinary and Legal Actions

1. The Company will carry out disciplinary actions for employees who violate compliance with this policy including direct supervisors who neglect wrongdoing or acknowledged but did not manage wrongdoing. Direct supervisors may receive disciplinary actions up to termination of employment. Ignorance of this policy and/or related laws cannot be claimed as an excuse for non-compliance.

2. Representatives, business mediums, distributors of goods/services or any contractor of the Company who violate criteria in this policy provide inaccurate data when the Company’s enquirers ask for information concerning actions potentially in conflict with this policy may have contracts terminated.

Reporting Results to Complainants

The Company will inform complainants who disclosed names, addresses, telephone numbers, email or other contact channels of progress and results from considering complaints related to wrongdoing and corruption. Nevertheless, if there is reason or necessity concerning personal information and confidentiality, the Company may not provide information related to investigations or disciplinary actions.

Protection of Complainants, Whistle-Blowers, and Related Parties

Complainants or whistle-blowers are to be suitably and fairly protected by the company, which implies no change in job titles, job nature, workplaces, job relief, threats, job harassment, dismissal, or unfair acts. The company will keep their complaints confidential and not disclose them to unrelated parties except when required by law.

Those with knowledge of complaints or related information must maintain confidentiality and not disclose it except when required by law. If this is intentionally violated, the company will punish them under its regulations or the law, or both, as seen fit.

Confidentiality

1. All related persons must keep the fraud information and the investigation confidential and disclose details to anyone other than those who have a legitimate need to know.

2. The Investigation Report may not be disclosed to anyone in order to avoid damaging the reputation of an employee suspected but subsequently found innocent of any fraud, and to avoid potential civil liability.

In recent years, the company has received no 2019 complaints involving misconduct or behavior.

Section 4: Disclosure and Transparency

The Company places importance on the disclosure of information with accuracy, completeness, transparency and equality for financial statements and general information, and also other information that would impact the Company’s share price. To ensure that investors and all other related parties have free access to the information, the Company publicises the information through different media channels such as website of The Stock Exchange of Thailand, Form 56-1, Annual Reports (Form 56-2) , and at the Annual General Meeting of shareholders. In addition, the Company’s information which has been reported to The Stock Exchange of Thailand, shareholders and investors, will be publicised in both Thai and English language on the Company’s website bwg.idea-boomer.com. This is another communication channel which is very timely and provides an easy access to the users.

Discloses significant information through the SET’s channel as well as on its website in both Thai and English. Such significant information includes annual report, corporate governance policy, company information and news releases. The website is regularly updated to provide the shareholders and outsiders to have easy access to timely and accurate information for their best benefits. The significant information is as follows:

1. Essential information consists of both financial and non-financial information. The financial statements must be reviewed and audited by the auditor and deemed to be accurate in all material respects and in conformity with the generally-accepted accounting principles. They are approved by the Audit Committee and the Board of Directors before disclosing to the shareholders. The Board of Directors is required to disclose a report on its responsibilities for the financial report, a report of the Audit Committee and a report of the auditor in the annual report. Also discloses connected transactions in the 2017 Annual Information Form (Form 56-1) and Annual Report (Form 56-2).

2. The Company was able to submit both the quarterly and annual financial reports for 2019 within the schedule determined by the SEC and SET. The Company emphasized on preparing financial statement properly in accordance with generally accepted accounting standards, using appropriate accounting policies applied on a consistent basis. The Company was very rigorous in submitting financial statements and financial report within the schedule prescribed by law. The Company’s financial statements were certified with unqualified opinions by the auditor and have never been ordered by the SEC to make any correction thereto and have never been submitted late.

3. The Company prepared Management’s Discussion and Analysis by giving analytical explanations on financial position and operation results of the Company and forwarded them to the SEC and SET together with all quarterly financial statements and publicized them on the Company’s website as information supporting disclosure of all quarterly financial statements to enable investors to be aware of and comprehend the changes to the financial position and operation results of the Company in each quarter better.

4. The Company provides a statement of the Board’s responsibilities concerning the Company’s financial report. This statement is presented in the Company’s annual report.

5. The Company reveals auditing fees and other service fees paid to its auditors in Form 56-1 and the annual report. In 2019, the company assigned Karin Audit Company Limited with capability and experience to be the independent auditor and was approved by the Securities and Exchange Commission. The financial statement was verified to be accurate in accordance with accounting standards and also passed the approval of audit committee and the board of directors before disclosure to shareholders.

- 5.1 the company and subsidiaries paid audit fees of Baht 4,355,000 to Karin Audit Company Limited. Better World Green PCL. by 1,250,000 baht/Better West Care Co., Ltd. by 435,000 baht/Better World Transport Co.,Ltd. by 350,000 baht / Earth Tech Environment Co.,Ltd. by 1,970,000 baht / Be Green Development Co.,Ltd. by 160,000 baht. Better Me Coltd. By 190,000 baht. However, the audit firm and selected auditors are independent and have no relationship with and benefits from the Company, its executives, major shareholders or individuals related to such persons.

- 5.2. Other Fees - None –

6. The Company discloses roles and responsibilities of the Board of Directors and subcommittees, number of meetings, attendance of each member in 2019, as well as trainings and knowledge development activities of the Board and discloses remuneration of directors and senior executives, indicating forms and types of remuneration, in Form 56-1 and the annual report.

7. The Company disclosed the backgrounds of all directors in the annual report, Report 56-1 and on the Company’s website by specifying their names-surnames, ages, positions, educational backgrounds, training, working experiences, number of shares in the Company and proportion of shareholding, holding of director office in any other company, clearly separating into the heading of listed company and other companies, date appointed as director, as well as family relationships among executives

8. Remunerations of directors of the Company reflected the obligations and responsibilities of each director. The Company paid directors their remunerations in 2019 at such rates as approved by the 2019 AGM, which were the same rates as approved by the 2018 AGM, which have remained unchanged since 2011 In this regard, the Company disclosed the amount and type of remuneration received by each directorfrom the Company and subsidiaries individually in the annual report (56-2) and Report 56-1 under the “Management Structure” and publicized them on the Company’s website.

9. In 2019, the Company paid high-level executives their remunerations in accordance with the Company’s policy to pay remuneration by reflecting the obligations and responsibilities of each high-level executive and at suitable rates by comparing with the same type of business, and disclosed the details of remunerationpayment in respects of format, nature and amount of remunerations in the annual report and Report 56-1.

10. The Company established a policy requiring directors and senior executives to submit copy of report on holding of securities of the Company in case of changes to the holding of securities (Form 59) to the Company within the same period when the directors and senior executives delivered it to the SEC Office for retention by the Company as evidence and report to the Board of Directors meetings on a regular basis. Directors and senior management who wish to buy or sell the securities issued by the Company, shall notify the Company Secretary at least one business day in advance of the date of entering into such transaction. Moreover, the Company disclosed changes to the holding of securities of the Company by directors and high-level executives by illustrating in the annual report the number of shares held at the beginning of the year, changes during the year and the number of shares held at the end of the year.

11. In addition to disclosing information as specified in regulations through the SET, the Company has disclosed important Company information, both in Thai and English, to the public on the Company’s website. All disclosed information is up-to-date and includes the following:

- - The Company’s vision and mission

- - Nature of Business

- - List of members of the Board of Directors, Subcommittees, and executives

- - Financial statements, financial status and performance

- - Downloadable Annual Registration Statements Annual Report

- - Shareholders structure and the Company structure

- - Invitation letters for shareholder meetings, other relevant documents and minutes of shareholder meetings

- - Corporate Governance Policy, Code of Conduct, Anti-Corruption Policy, Management Policy as well as other policie

- -Contact information for Investor Relations

The company recognizes the importance of information about company, both financial and non-financial that influences the decision-making process of its shareholders and stakeholders. The executives place importance on disclosure of information, that is accurate, complete, regular, timely and in accordance with the criteria stipulated by the SEC and the SET. The company, therefore, assigned the Secretarial Company and Corporate Marketing and Communication Department contact number 0-2012-7888 ext. 533 and 344 to disclose material information about company and to supervise the financial reporting system, as well as other material information that may affect the price of company's securities, i.e. financial statements, operational results disclosed through the (www.setlink.set.or.th) to investors. The company presented operational results and disclosure information to investors, shareholders and relevant persons under direct and indirect methods as follow.

- Direct : The company presents its operational results to the securities analysts, investors and employees regularly in the form of analyst meetings, during meeting presentations and company visits where executives are met to enquire about progress of its operational results.

- Indirect : The company provides information about the company, operational results, financial reports, including other reports through the Stock Exchange of Thailand and can be found under the Investor Relations tab of the Stock Exchange of Thailand website www.set.or.th or the company's website bwg.idea-boomer.com in Thai and English.

Or people who would like more information on the Company’s operations, please contact Better World Green Public Company Limited 488 Soi Ladprao 130 (Mahadthai 2), Klongchan, Bangkapi, Bangkok 10240, Thailand. Contact number 0-2012-7888 ext. 533 and 344

In 2019, the Company sent quarterly and annual financial statements on time and consistent with the criteria notified and specified by the Stock Exchange of Thailand without notifications from the Securities and Exchange Commission to amend financial statements.

Section 5 : Responsibilities of the Board of Directors

The Board of Directors was appointed by shareholders with roles and duties to govern the business on behalf of shareholders who oversee operations in order to build confidence that the Company’s activities are consistent laws and ethics. The Board of Directors is independent from the Company’s executives and duties and responsibilities are clearly divided between the Board of Directors and executives through specification of roles, duties and responsibilities of the Board of Directors, the Chairman of the Board, the Chief Executive Officer and the Managing Director (see information on the Board of Directors’ scope of authority, duties and responsibilities, etc., at “Management Structure”).

The Structure of the Board of Directors

1. As at 31 December 2019 the Board of Directors comprised 9 qualified and knowledgeable members with wide experiences and specialties beneficial to the Company. The number of directors was appropriateand adequate to the size and type of the Company’s business with non-executive directors having experiences in major business being operated by the Company. The structure of the Board of Directors comprised:

- (1) 3 Executive Directors and

- (2) 6 Non-Executive Directors, of which 3 directors were independent directors or 1/3 of the total number of directors,

The company disclosed the structure of the board of directors, duties and responsibilities of the selection criteria. Important information of each director such as name-surname, position, date, month, year of being appointed to be director As well as the biography of each director In the annual report and Form 56-1, as well as the company's website at bwg.idea-boomer.com

2. Diverse board The skills are consistent with the business strategy of the company through the preparation of a table of skills (Board Skills Matrix) and a variety of educational background, experience, without any differences. Details of the biography of directors appear in the heading of "Board of Directors and Executives"

3. Independent directors account for more than one-third of the Board.Today there are 3 of them,

4. The Company has one woman Independent Director

5.None of the Company’s directors or executives is or was an employee or partner of the external auditing company providing services to True Group for the past two years.

6.The Chairman of the Board is a non-executive director and the President (Co) is not the same person as the Chairman. The roles and responsibilities of the Chairman are in accordance with the law. The roles and responsibilities of the President (Co) are determined by the Board of Directors and the authority and responsibilities of the Chairman and the President (Co) are disclosed under “Management structure” in the annual report and Report 56-1 which is also posted on the Company’s website.

7. The Company’s Internal Audit Department reports directly to, and is accountable to, the Audit Committee.The Company has disclosed the name and profile of the head of Internal Audit Department in the annual report and Report 56-1 which is also posted on the Company’s website.

8. The function of Company Secretary is in place to serve the Board of Directors in area of providing advice on laws and regulations related to the Board, helping organize the Board’s activities, and monitoring compliance with the Board’s resolutions. The Company Secretary is training courses as well as participating in any company secretary-related training courses.

The Company has disclosed company secretary’s job description, working experience and related training courses attended in the annual report and Report 56-1 which is also posted on the Company’s website.

9. Board of Directors appoints sub-committees to perform specific duties and present topics to the Board of Directors for consideration or acknowledgement. Each sub-committee has scopes of authority and duties according to specifications of each of the following sub-committees’ authority and duties (see information on each sub-committee’s scope of authority, duties and responsibilities at “Management Structure”):

- Audit Committee

- Risk Management Sub-Committee

- Recruitment and Remuneration Consideration Sub-Committee

- Corporate Governance and Corporate Social Responsibility (CG&CSR) Committee

- Executive Board of Directors

Segregation of Duties

The Company has clearly segregated duties and responsibilities between the Board of Directors and executives as follows:

1. The segregation of duty of the Board of Directors and management The Board of Directors has its duty to govern the operations in accordance with the provisions of the law, the Company’s objectives, articles of association, the resolutions of the shareholders’ meetings, and the Corporate Governance Policy. In governing the Company, the directors must exercise their business judgment and act in what they reasonably believe to be the best interests of the Company and its shareholders The Management is responsible for implementing the Company’s strategy, Achieving the planned objectives, and handling the day-to-day administration and affairs of the Company.

2. The segregation of duty of Chairman of the Board of Directors and Chief Executive Officer Both the Chairman of the Board of Directors and the Chief Executive Officer must be competent and have the appropriate experience and qualifications for their positions. In order to maintain a balance between the supervisory and management functions of the Company, one person cannot hold both of these positions simultaneously.

The Chairman of the Board of Directors is a non-executive director who acts as the Chairman of both Board of Directors and shareholders’ meeting.

The Chief Executive Officer is the head and leader of the Company’s executives, and is accountable to the Board of Directors for managing the Company in order to achieve all its planned objectives.

Term of Office of Directors

1. A director shall be appointed for a term of office of 3 years and a retiring director is Eligible for re-election. The Company has no restrictions on re-election of retiring director and age of directors. However, the Company mainly considers their abilities to perform duties.

2. Term of office of directors is in accordance with the Company’s Articles of Association. At every annual general meeting, one third of the Directors who are subject to retirement by rotation shall retire. The director to retire by rotation shall be those who have been longest in office since their last appointment and the retiring director is eligible for re-election.

3. Where a vacancy occurs in the Board of Directors for reasons other than the retirement by rotation, the Board shall elect a person who is qualified and is not prohibited under Section 68 of the Public Limited Companies Act B.E.2535 by a vote of not less than three-fourth of the number of shareholders as the substitute Director at the next meeting of Board of Directors. The substitute Director shall hold office only for the remaining term of office of the Director whom he or she replaces.

4. An independent director shall be appointed for a term of office of not more than 3 consecutive terms or not more than 9 years, whichever is longer. If the Board of Directors deem that it is necessary to hold office more than 3 consecutive terms or more than 9 years, the tenure of such independent director shall be extended.

High-Level Executives Succession Plan

The Board of Directors is aware of the significance of human resources so the Nomination and Remuneration Committee is established to prepare the succession plan for the position of Chief Executive Officer and high-level executives from the department manager level or higher level and report directly to the Chief Executive Officer (CEO) based on the stipulated rules, including consider and review such plan annually.

Policies and Methods of Practice in Positions As Directors of Other Companies for Directors and Executives

The Board of Directors gives importance to the performance efficiency of directors, thereby enabling directors to fully devote time to governing the company’s business. Therefore, policy has been set to limit the number of other registered companies in which directors and executives can hold positions as directors to no more than five other registered companies. Currently, no directors of the company hold positions exceeding set criteria.

Leadership and Vision

The Board of Directors participates in setting short-term and long-term vision, obligations and strategies including goals and business plans by annually revising the company’s vision, obligations, strategies and business plans. Furthermore, the Board of Directors has set success indicators for the organization in each aspect such as growth building and finance including preparation of vital work systems such as the internal control system and the risk management system. The Board of Directors monitors management performance by stipulating that the Managing Director make quarterly reports in order to review and ensure effective company performance.

Business Governance Policy

The company has established a written policy for governing the business and the Board of Directors will hold regular reviews of these policies for adherence to the aforementioned policy. Moreover, the company will act according to the rules and various regulations set forth by the Securities and Exchange Commission and the Stock Exchange of Thailand and will disclose reports on the direction of the business in the annual reports (Form 56-2) and in the form showing the list of annual information (Form 56-1). It is also disseminated at bwg.idea-boomer.com. Business care policy is composed of governance in various areas as follows:

Zero Tolerance Policy on Bribery and Corruption

The company is committed to zero tolerance policy against every type of bribery and corruption. To operate in a business at risk for corruption, and with careful consideration and practice, the company has prepared written zero tolerance policy against bribery and corruption along with stipulating that the company and subsidiaries comply with anti-bribery and anti-corruption policies with the aim of pushing for and maintaining corporate culture by adhering to the fact that “corruption is unacceptable in transactions with the public and private sector” as disseminated by the company in bwg.idea-boomer.com.

Operational Guidelines Zero Tolerance Policy against Bribery and Corruption

1. The company has zero tolerance policy against bribery and corruption while complying with all anti-bribery and anti-corruption laws in Thailand.

2. The company will not directly or indirectly participate in bribery and corruption. The company is committed to implementing an effective anti-bribery and anti-corruption system.

3. Company directors, executives and employees at every level are required to comply with the zero tolerance policy against bribery and corruption by not participating directly and indirectly in corruption and bribery of public and private officials such as the personnel of companies involved in transitions with the company to gain or maintain businesses or competitive advantages.

4. Employees are under obligation to neither neglect nor ignore. When actions fitting the scope of corruption are encountered, employees are required to notify supervisors or the persons responsible and cooperate in investigating the facts.

5. Any action under the anti-corruption policy is to implement practice guidelines set out in the company’s business ethics and regulations, including related company operational manuals and any other practice guidelines specified by the company in the future.

6. Corruption is a violation of the company’s business ethics requiring consideration for disciplinary action based on regulations set forth by the company. Furthermore, corruption may result in penalties according to the law if the aforementioned action is illegal.

7. The company will give justice and protection to employees who have reported or cooperated in reporting corruption involved with the company.

8. The company recognizes the importance of communication and public relations to build knowledge and understanding among company directors, executives, employees and persons associated with the company on topics requiring compliance with this anti-corruption policy.

9. The company is committed to building and maintaining corporate culture with a firm belief that corruption is unacceptable in transactions with the government sector and the private sector based on protocol.

Business Ethics

The Board of Directors has established ethics to provide guidelines and good recommended practices for directors, executives and employees to uphold as guidelines for performance of duty in line with the company’s mission with sincerity, honesty and fairness in its treatment of the company, every stakeholder group, the general public and society. Furthermore, the company designated a system to regularly monitor practices according to the aforementioned guidelines. The company has provided continual trainings and explanations for employees to comply with business athics. The company’s directors, executives and employees are under obligation to strictly adhere to ethics. Supervisors at every level are under obligation to observe and promote compliance with designated ethics among subordinates along with conduct aimed at creating a good example to promote compliance among employees. The company disseminates its business ethics at bwg.idea-boomer.com.

Internal control systems

The board of directors places importance on the internal control systems both at the executive level and the operational level in order to ensure efficient operations. Furthermore, the company has clearly set forth duties and authority for the executives and employees in writing, with respect to control over and use of the company’s assets to generate profit. The company has also divided the duties of employees and controllers with separate audits in order to create a balance between each other.

The company has established an Internal Audit Department to audit the primary operations and significant financial activities of the company to assure performance in the specified direction that is effective and in compliance with the laws and specifications related to the company's internal control systems. The audit department examines significant items continually with reports on the findings sent directly to the audit committee. The internal audit is able to fully inspect and maintain a balanceIn this regard, the Company has assigned Miss.Siriphorn Suasakul to be responsible for internal control and audit systems. With details about the chief of internal audit as follows

Name : Miss. Siriphorn Suasakul

Position : Manager of Internal Audit

Education

- Audit Committee

- Master's Degree: Kasetsart University (Majoring in Marketing).

- Bachelor’s Degree: University of the Thai Chamber of Commerce (Accountancy).

- Auditor and Tax Auditor.

- Being trained in Anti-Corruption : The Practical Guide (ACPG 23/2015).

- Completed the ISO 9001 : 2015, ISO 14001 : 2015 and OHSAS 18001 : 2007 Internal Audit.

- Completed the Business Risk Management for ISO 9001 : 2015, ISO 14001 : 2015, ISO31000:2009 Guide line.

- Being trained in Workshop COsO 2013 Internal Control Framework.

- Being trained in Update COSO Enterprise Risk Management : Integrating with Strategy and Performance.

Experience

- 2561 – Present Company Secretary Better World Green Public Company Limited

- Internal Auditing Manager.Better World Green Public Company Limited

- Internal Auditing Manager.TEKA Construction Company Limited

Duties and Responsibilities of the Head of Internal Audit

- 1. Assess the adequacy and effectiveness of controls Risk management, supervising operations And the organization's information system Including ethics for executives and employees of the organization

- 2. Check the accuracy and reliability of financial information.

- 3. Examine items that may have conflicts of interest, the potential for fraud and the efficiency of the organization in managing the risk of corruption within the organization.

- 4. Report key issues about the control processes in the organization's activities and key issues found about the control processes.

- 5. Advising management In order to ensure good governance and operations with efficiency and effectiveness

- 6. Performance report of management performance, performance according to the annual audit plan And the adequacy of the resources needed to perform the audit

- 7. Coordination, monitoring, overseeing controls Risk management Compliance with laws, codes of ethics, environment and ensure compliance with laws, regulations, orders, policies and plans.

- 8. Coordinate with the auditor to be able to understand the plan. And determine the scope of the internal audit For mutual benefits for the organization

- 9. Formulate guidelines for maintaining and developing the competency of the internal auditors in writing And continuously follow up the results

- 10. Perform other duties related to internal audit as assigned by the audit committee. Or as requested by the management

Appointment and Consideration of Auditor’s Remunerations

The Board of Directors gives consideration to selecting, nominating and removing independent persons to function as the company’s auditors as well as propose auditor remunerations. Proposals are made by the Board of Directors at meetings of shareholders for approval. Accordingly, the Board of Directors and Audit Committee view that Karin Audit Co., Ltd. has professional expertise, independence and neutrality with continuous experience in auditing work in auditing and having effective knowledge in the company’s information and other companies in the group. Hence, the audit fee for 2019 was set at the amount of 4,355,000 baht as follows:

Better World Green PCL. by 1,250,000 bah

Audit fees for subsidiaries

- Better West Care Co., Ltd. by 435,000 baht

- Better World Transport Co.,Ltd. by 350,000 baht

- Earth Tech Environment Co.,Ltd. and subsidiaries by 1,970,000 baht

- Be Green Development Co.,Ltd. by 160,000 baht.

- Better Me Co.,Ltd. by 190,000 baht.

- Other Services --None--

the audit firm and selected auditors are independent and have no relationship with and benefits from the Company, its executives, major shareholders or individuals related to such persons.

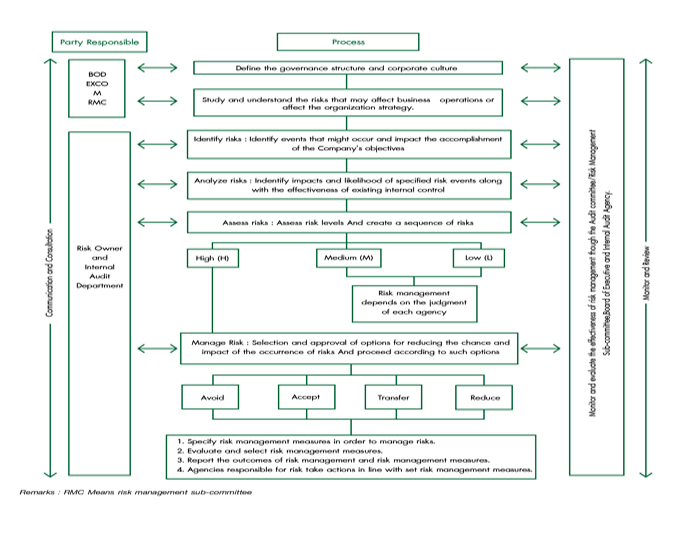

Risk Management

The board of directors set clear specific and measurable goals for business performance. The executives compare actual performance outcomes against the goals determined by internal and external evaluations by assessing risk factors, analysis of causal factors and events that cause risk and also assigned the related department to continuously monitor the risks and report the progress to the supervisors.

Internal Control Systems